Image Source: The Ohio Society of CPAs

On January 8, Ohio Governor Mike DeWine signed HB 238, which allows for two pathways to a CPA credential. The changes aim to address the CPA shortage by offering more flexible routs to licensure. In essence, the bill phases out the 150-credit-hour requirement for taking the CPA exam and allows mobility of out-of-state CPA credentials.

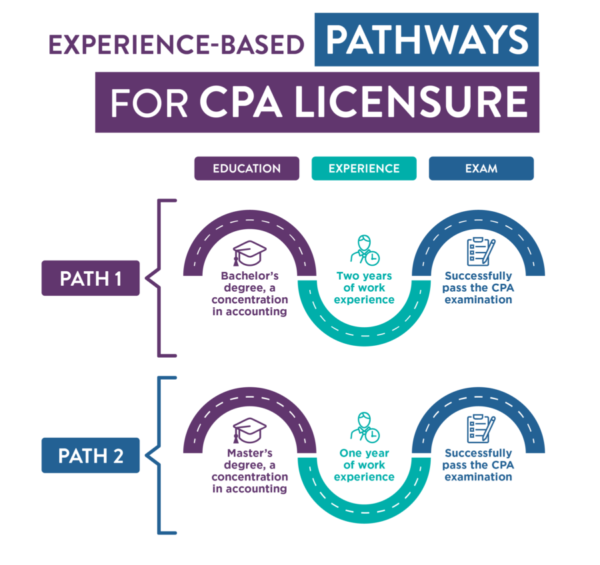

Effective January 1, 2026, two pathways to CPA licensure will be available:

- A master’s degree, completing the required accounting concentration of coursework, one year of experience, and passing the CPA Exam

- A bachelor’s degree, completing the required accounting concentration of coursework, two years of experience, and passing the CPA Exam

An “accounting concentration” is defined as 30 ACC hours and 24 business hours—these requirements remain unchanged. Additionally, students who sit for the any part of the CPA exam before the effective date are still required to earn 150 total credit hours and complete 1 year of experience before earning their CPA license.

The law also impacts what students need to qualify to sit for the exam. Before 1/1/2026, students need 120 overall hours, 24 ACC hours (specific courses are required), and 24 business hours. After 1/1/2026, students can apply to sit for the exam 180 days before their expected graduation date.

There is still uncertainty regarding how the new law will impact the mobility of an Ohio CPA license—many jurisdictions and states have similar legislation working its way through their legislative processes. Students who are already on track for the 150 credit hours should stay the course for the time being, particularly those who are contemplating working out of state.

For more information and FAQs, see the OSCPA news release.