Professor Matt Wieland was invited to present a research proposal for the Journal of Financial Reporting’s

Improving Financial Reporting Conference on October 7, 2022. His paper was one of a select few that

were shared with the FASB (Financial Accounting Standards Board) staff to provide feedback based

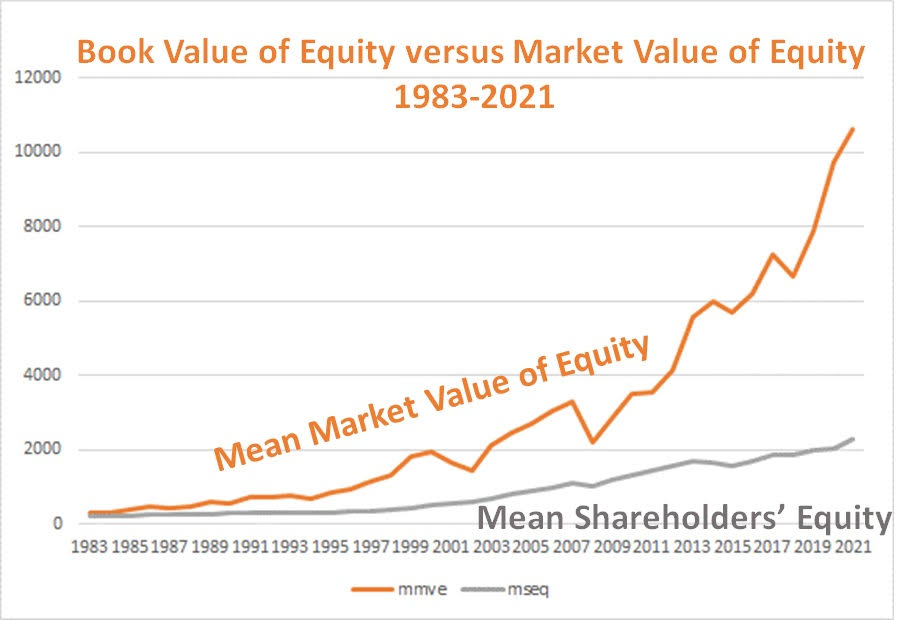

on their potential relevance to current standard-setting projects. His proposal begins with the fact that

we observe the market value of equity detaching from the book value of shareholders’ equity, the

accountants’ “equity value” over the last 20-plus years. During this time, we also observed an increasing

investment in intangible assets.

Prof. Wieland proposes to examine the role of advertising spending in explaining this growing difference. His study will replicate and extend research published in 1987 by Bublitz and Ettredge in The Accounting Review. Their paper suggests advertising spending creates little future benefits. Prof Wieland’s study will examine whether that relationship has changed in more recent periods using the original methodology and additional analyses. The findings from the paper will also inform the FASB on the value of disaggregating expense items to investors and financial statement users. This research project was funded by a Department of Accountancy summer research grant that allowed Prof. Wieland time to devote to gaining a better understanding of the problem and identifying a question of interest to users.